Reopening of the Economy Drives Urban-Rural Divergence Deeper

31 March 2022

Citi analysts highlight a rise in Broad recovery index to 4.1%MoM in Feb-22 due to reopening led by a pickup in urban consumption. With 9.6%MoM jump in Feb-22, our urban consumption index has crossed pre-Covid levels for the first time however Rural consumption index is still ~6% below pre-Covid signifying a sharp difference in the breath of recovery. Key Points appended below:

- 1. 4QFY22 – Activity Momentum:Activity rebounded in February while remaining below the recent highs. The Broad recovery index rose by 4.1%MoM in Feb-22 to 102.3 (100=Pre-Covid). The index is still lower than its peak in Dec-21 (105).For the first time after the pandemic the Urban Consumption Index climbed above the pre-covid levels with seven of the nine indicators above or close to pre-Covid levels in Feb-22 indicating a better breadth of recovery. Rural Consumption continues to be a drag with rural consumption index (94.0) remaining well below pre-Covid levels, despite the 3.6%MoM rebound in Feb-2022. Tractor sales in Feb-2022 were ~30% below average monthly sales in 2021; two-wheelers sales and Diesel consumption remained subdued however decline in the jobs generated under MNREGA signify a reducing stress in Rural Job Market.

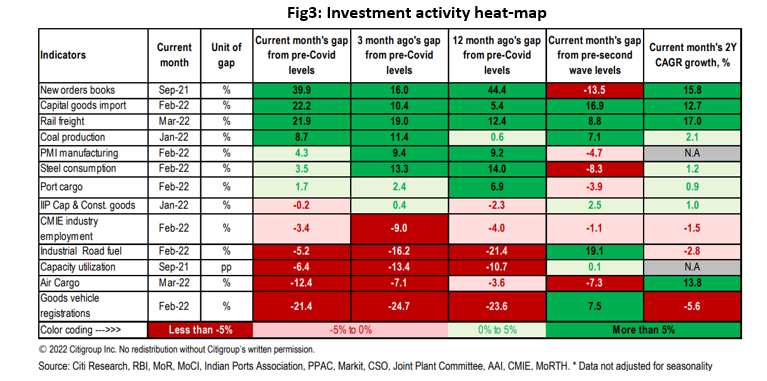

- 2. Investment: The Investment Index in Feb-22 did not record any improvement in Feb-22, however the index did not fall during the Omicron wave in Jan-22 and continues to be above pre-Covid levels. National highway construction in Feb-22 (1361km vs 625km last 6-m average) picked up pace albeit is much lower than the same period last year (-32%YoY in Feb-22). Capacity utilization in the manufacturing sector had jumped to 68.1% in Sep-21 from 61.1% in Jun-21. Geopolitical uncertainty is an additional headwind for investment while the above bodes well for Capex revival.

- 3. GDP Forecast Supported by Recovery: The Narrow recovery index is near it’s peak owing to a continued recovery in Mar-22. March MTD the Narrow recovery index has witnessed an increase of ~4%MoM suggesting that economic activity is ~10% above pre-Covid levels. Citi analysts maintain that despite omicron, India could avoid a QoQ real GDP contraction in 4QFY22.

For more updates please visit Citi Wealth Insights