DAILY NEWSLETTER

VIDEOS

Can the Trump Effect Continue to Lift Markets Citi Wealth Insights

Europe Politics Present an Opportunity Citi Wealth Insights

Chinas Growth Surprise This Year Citi Wealth Insights

12 April 2022

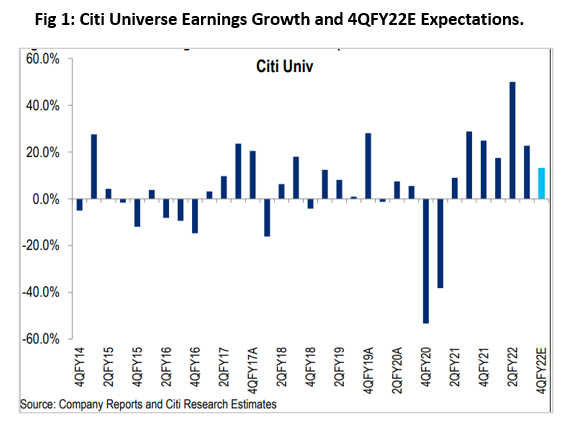

India Inc is set to declare the March 2022 Quarterly earnings over the next few weeks. These financial results for the March ending quarter occurred amid a time of unprecedented global volatility, persistent inflationary pressures, continued supply chain disruption and a Hawkish Fed.Citi analysts expect Citi Universe 4Q earnings growth at ~12% YoY, largely driven by financials (lower credit costs). Ex-financials they expect flattish earnings YoY. Margin pressures are evident everywhere with sectors like autos, pharma, and IT to be impacted the most.

Key Points Appended Below:

For more updates please visit Citi Wealth Insights

Can the Trump Effect Continue to Lift Markets Citi Wealth Insights

Europe Politics Present an Opportunity Citi Wealth Insights

Chinas Growth Surprise This Year Citi Wealth Insights