RBI MPC April'22 Preview: A Dovish Nudge to Manage Hawkish Risks

07 April 2022

The first meeting of the Monetary Policy Committee for the financial year 2022-23 is being held between April 6-8, with policy decisions expected to be unveiled on 8th April 2022. The RBI is also expected to release the semi-annual Monetary Policy Report on that day, detailing the underlying assumptions behind their growth and inflation forecasts. What should you expect as an outcome even as central banks globally have begun raising interest amidst persisting inflationary pressures? Will the MPC tinker with the key policy rates or shift its focus on changing the policy stance? How will MPC navigate the coexistence of elevated core inflation and persistent negative output gap? Key Points appended below.

Key Highlights: Citi’s Take

- 1. Inflation : The RBI may be prompted to push up the FY23 CPI forecast in the range of 5 – 5.5% (4.5% earlier (Citi forecast 5.7%) on account of the surge in commodity prices. The average headline CPI over the past 2.5 years is at 5.8% which is much higher than the 4% medium term target (even Core at 5.3%). Inflation is expected to come off in 2H due to an expectation of backwardation of commodity prices, particularly oil.

- 2. Supply Shock: RBI perceives current inflation problem as primarily “supply side’’ with MPC not equipped with effective tools to address the same. Citi analysts believe Inflation problem can be characterized in 3 P’s of Persistence, Pervasiveness and Perception. The trimmed mean CPI inflation is highest since 2015 with diffusion index pointing to a more generalized inflation trend.

- 3. GDP : Citi analysts expect GDP growth forecast to be trimmed down to the 7 – 7.5% range (7.8% earlier, Citi 7.5%). They expect Negative output gap to likely persist for the entire year, which may prompt the MPC to conclude that the “ongoing domestic recovery is still incomplete requiring continued policy support” (Feb Policy Statement).

- 4. Policy Stance : The focus in April MPC would be on the stance change. RBI may modify the forward guidance by altering the relative weights of growth and inflation. Citi analysts believe a change to a “Neutral” stance may provide MPC with more operational flexibility incase inflationary pressures intensify however expect RBI to find a more suitable stance between accommodative & neutral instead of outrightly changing the stance to neutral.

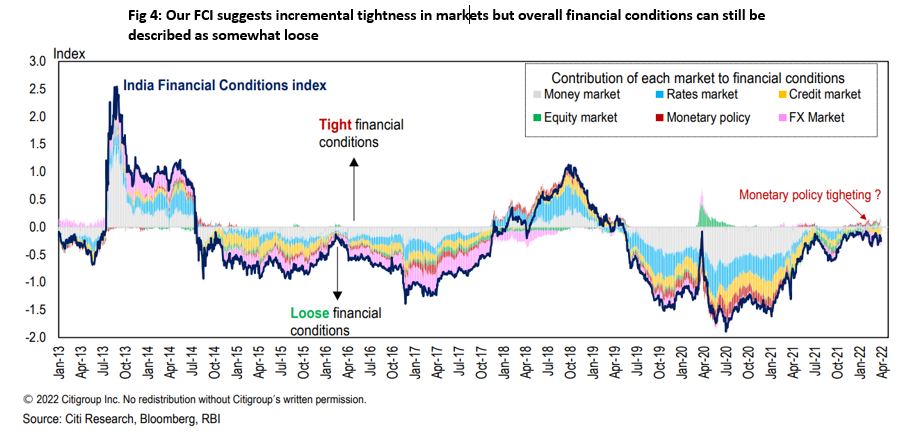

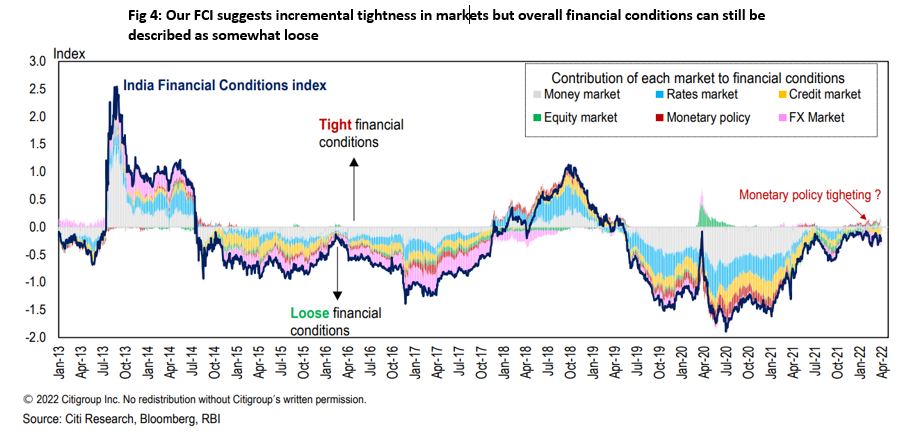

- 5. Liquidity Normalization : RBI may highlight the ongoing process of liquidity normalization but might not announce too many additional steps in this direction. RBI has been reducing the Durable Surplus Liquidity in the system by ~INR 3.3trn in last six months (till mid-March). RBI’s balance sheet has already contracted by ~INR 1.85 trn – ~3% drop from the peak. Variable Rate Reverse Repos (VRRR) has pushed up the weighted average reverse repo rate by ~55bps in signs of monetary policy normalization.

- 6. OMO : India’s 1H FY23 central government borrowing program is set at INR 8.45 trillion, ~59% of the full year target of INR 14.3 trn.The RBI had purchased 19% in FY21 and 34% in FY22 of the 1H issuances respectively, including the announcement of a specific Government Securities Acquisition Program (GSAP) in April 2021. Citi analysts believe RBI will have to provide INR 2 – 2.5trn OMO support in 1HFY23 (25 – 30% of gross issuances) to support a smooth passage of the borrowing program and expect April policy to provide guidance on the same. Pre committing a G-SAP looks difficult given the inflationary pressures. HTM relaxations provided to the banks in February 2021 will expire from 1QFY23and RBI might consider some extension of these relaxations.

For more updates please visit Citi Wealth Insights